June 30, 2020 Last updated on June 16, 2023 by Bob Fisher Bob Fisher Landscape Trailers

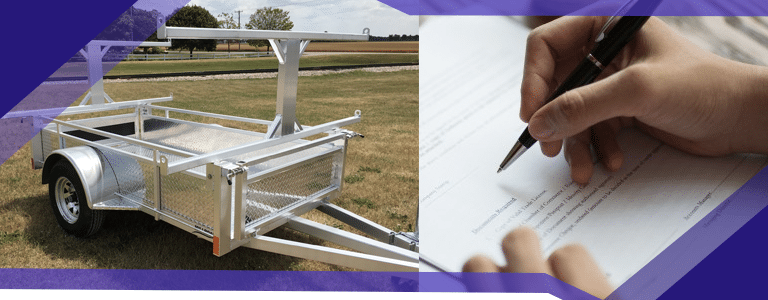

Landscaping trailers are utility trailers that have been adapted to suit the needs of landscapers and other construction professionals. Some types of landscaping trailers have tailgates that can be used as ramps when loading equipment. Some also have cabinets or tool racks built into the frame of the trailer for added storage.

Owning a high-quality trailer is a major benefit to many landscaping professionals, especially when it comes to loading and transporting equipment. Landscape trailers are just as susceptible to damage as vehicles, so you want to make sure your trailer is properly insured. If you are in the market to buy a new trailer, read below for more information on trailer insurance coverage.

In most provinces, you are not legally obligated to purchase insurance for your landscape trailer if it is for personal use only. However, it is always a smart idea to insure your trailer, especially if you have invested a lot of money in the trailer or the contents you haul. If the trailer is used for business purposes, most states require some level of coverage.

First, you need to determine if your trailer is covered by your existing personal insurance or if you need to purchase a separate commercial policy. Your personal auto insurance may cover your landscape trailer if it is used exclusively for personal purposes. Reading your policy’s fine print for more information.

Personal coverage often does not extend to trailers if you purchased the trailer after you bought your personal vehicle policy. Check with the policy provider to see if you have a window of time to add the coverage.

If your trailer is used for business purposes, you will likely need commercial coverage. Commercial insurance is more expensive, but it may also insure cargo or other trailer contents. This is especially important if you regularly haul large amounts of materials or supplies.

Generally, an insurance policy that covers your landscape trailer will only cover it when it is attached to another vehicle. Therefore, when the trailer is sitting in storage or if it becomes detached for any reason, it may no longer be covered by the policy. Before you buy, make sure the policy covers the trailer at all times, not just when it is being towed by another vehicle.

Similar to car insurance, you have options when it comes to trailer insurance. You can opt for basic coverage and just get liability insurance, or you can choose more comprehensive full coverage insurance. Liability insurance only provides coverage in case of damage or injuries caused by a car accident or other similar accident. A full-coverage policy will cover everything liability insurance covers while also replacing the trailer if damage occurs.

While covering your trailer with an insurance policy comes at a cost, the benefits outweigh the expense. Trailers are a significant investment, and you want to make sure your investment is protected. Purchasing insurance also means you will be covered in case of serious injury or damage.

Many people prefer to secure insurance before or shortly after purchasing a trailer. This is a wise decision because there is no guarantee you will be able to add the trailer to your personal vehicle policy. Also, you want to make sure there are no gaps in coverage.

If you are ready to purchase a high-quality, affordable trailer, contact Millroad Manufacturing today. We offer a wide range of trailers, including landscape, flat decks, dump, deck overs, tilt and fifth wheel. Contact us today for more information on pricing and insurance options.